As SealedBid continues to highlight the importance of preparing for the ongoing future of your company, we would like to welcome you to part two of the SBM M&A Spotlight Series regarding succession planning! In part two, this Spotlight will focus on “exit planning” and the important points to consider when transitioning ownership.

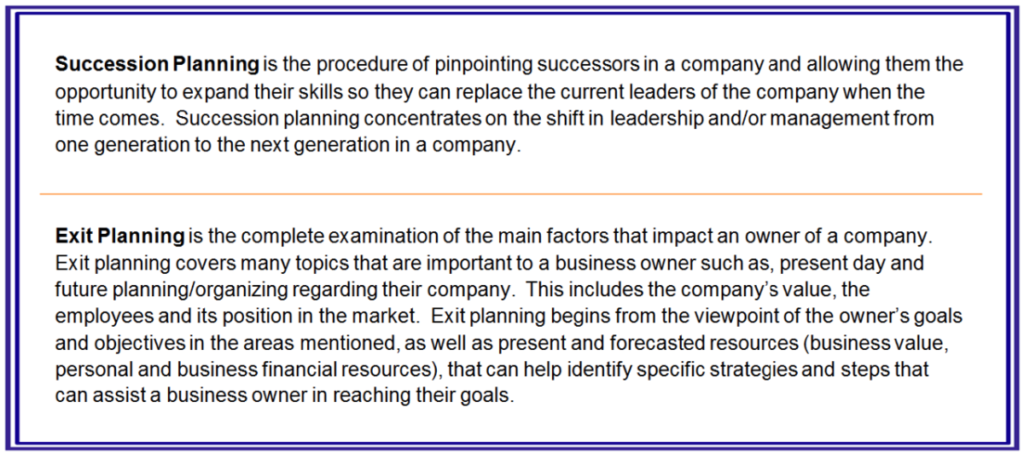

What is an Exit Plan and How Does it relate to a Succession Plan?

As discussed in the Spotlight: Succession Planning, an exit plan is what we consider to be the final culminating component within an overall business succession plan. A complete succession plan includes estate planning, the transitioning of leadership and ultimately a detailed exit plan pertaining specifically to a change in ownership.

A good exit plan analyzes all factors that impact the business and the current owner(s) including the future of the company, the employees and the community. Exit planning considers these factors and the ownership’s goals to create a strategy to maximize business value, personal and business resources and insure a successful transaction.

Where to Start an Exit Plan

Each business and ownership group will have unique challenges and priorities that dictate the first steps in creating an exit plan. Sitting down with advisors (e.g. business intermediary, attorney, CPA, banker, etc.) that are familiar with the business and the current M&A market will expedite the process.

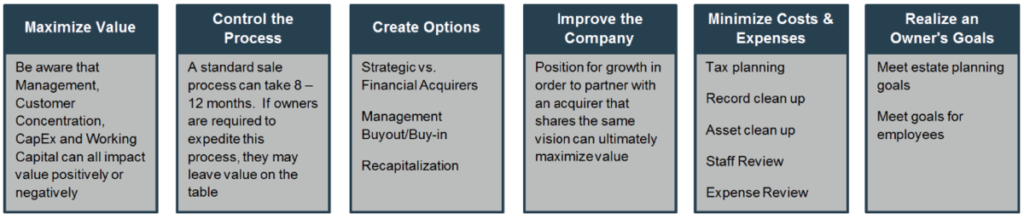

Elements of a Well-Designed Exit Plan

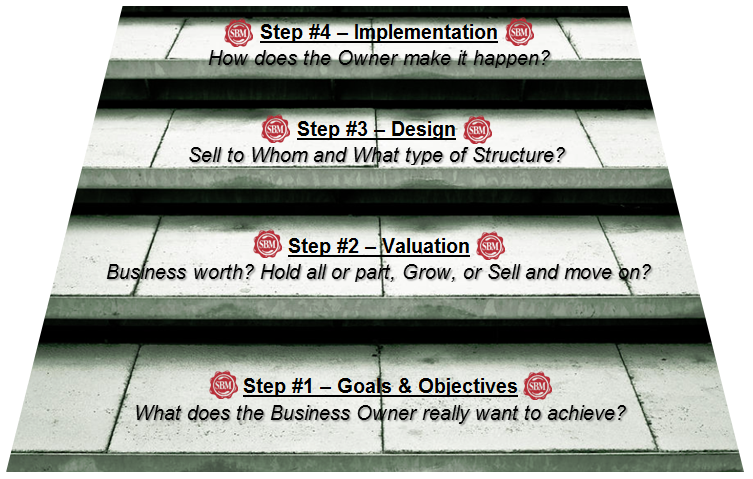

Although everyone does not start their exit plan in the same place, below we outline some general steps to assist with your exit planning strategy.

Exit Planning Steps

Common Pitfalls of Businesses that have Not Properly Planned for an Exit

-

Internal Conflicts

-

Among owners

-

Among managers

-

A new owner will want to have a strong foundation that continues with the company post-closing

-

-

Increased Costs

-

Appraisals

-

Excess inventory

-

Insufficient reporting

-

Tax planning

-

-

Management Control & Employee Future

-

Key managers and sales staff who do not have non-competes or non-solicits can hold a deal hostage

-

The legacy of the business may be in jeopardy without a clear plan for employees

-

Loss of trust in ownership/management

-

Why You Need an Exit Plan

-

Maximize the Value of your Company

-

When it is time to sell your company, having a well thought out exit plan will help to make your company more valuable

-

A potential acquirer will be much more willing to purchase a company that has created an exit strategy because that means there will be an easier transition for the new owner/owners

-

-

Be in Charge of What Happens to your Company

-

If there is no exit plan in place, it is difficult to decide what exactly happens to your company, especially if you need to sell unexpectedly

-

-

Help your Business Run Smoothly

-

Not only when it is time to sell, but also on a day-to-day basis

-

If there is an exit plan in place, there is a clearer understanding for employees with regard to their expectations and the overall goals of the company

-

An exit plan will help guide your strategic business decisions

-

SealedBid’s Role in Exit Planning

SealedBid is proud to have successfully served clients for over 25 years with M&A Advisory, Recapitalizations, Succession/Exit Planning, Family Transfers and Management/Partner Buy-outs. As a boutique firm, SealedBid engages in a limited number of projects at any given time to ensure we deliver the highest level of senior attention, expert advice and transaction experience to each client. Our experience, knowledge and attention to detail are crucial to successful succession planning.

- SealedBid works closely with business owners through all the steps of a successful succession plan.

- SealedBid helps guide business owners in a Family Transfer.

- SealedBid assists business owners in a Management/Partner Buy-out.

- Ultimately, SealedBid coordinates the due diligence process, secures the necessary financial statements and aids in negotiating the deal structure (adding tremendous value to business owners).

As you begin to develop your exit plan, remember that SealedBid has the experience, knowledge and expertise needed to successfully guide a transaction, family transfer or management/partner buy-out.

If you are interested in learning more about SealedBid, our services or our team, please do not hesitate to contact us at (952) 893-0232. SealedBid will work closely with you, your financial advisor, attorney, accountant and banker from the initial stages of pre-marketing through closing and post-closing.

In closing…remember to write your succession and exit plan long before you need them, so when the time comes to act, the terms and conditions are already defined and agreed to by all parties.